Oriented PE consumer packaging film, a confused market seeking clarity Significant investment with need to replace multi-material structures

AMI Market Intelligence has released an authoritative report offering a deep dive into the global polyethylene (PE) consumer packaging films market, providing industry stakeholders and investors with a comprehensive analysis of market dynamics, technological advancements, and competitive pressures shaping the global market.

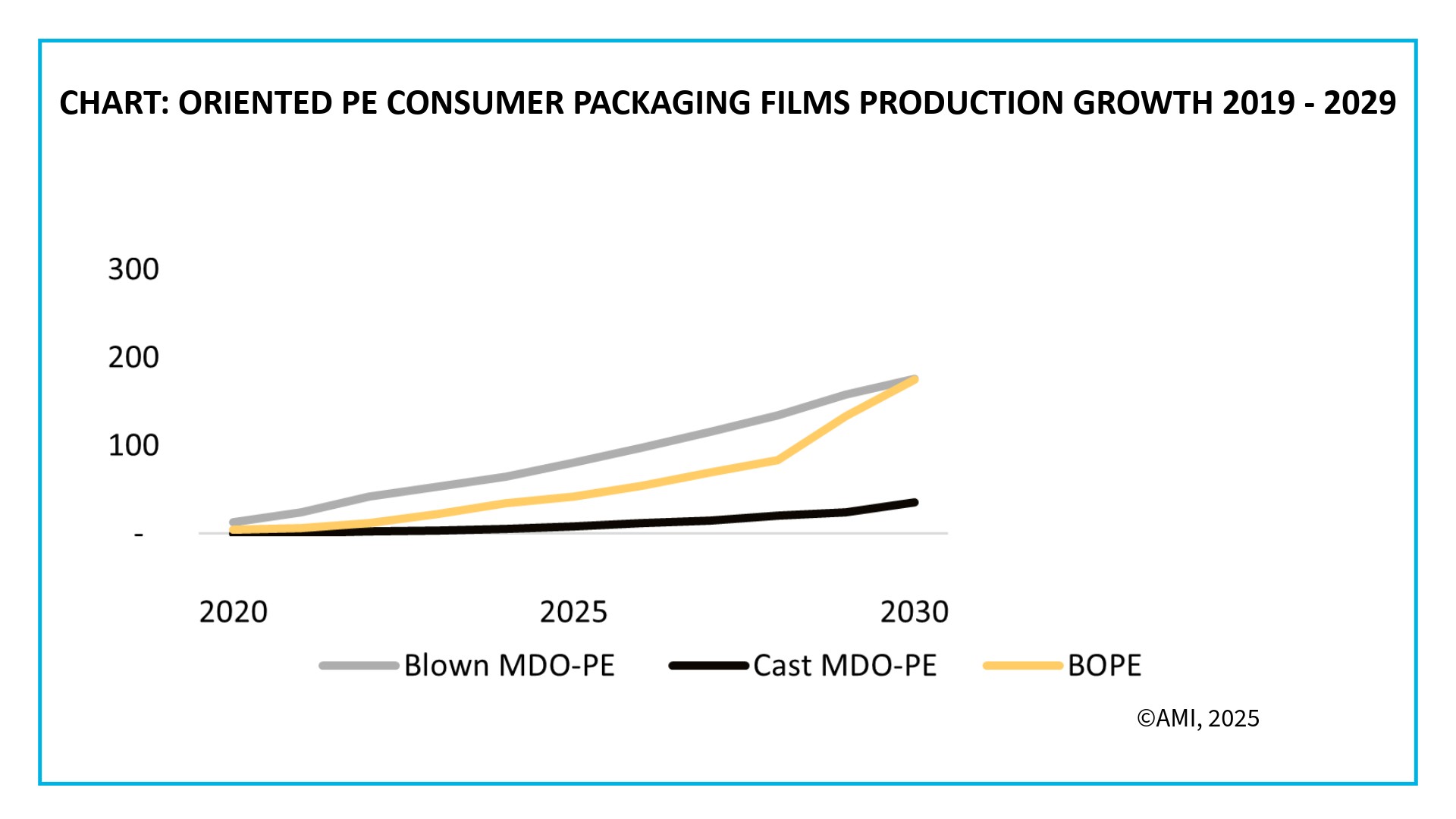

A key highlight of the report is the growing momentum behind oriented film technologies specifically Machine-Direction Oriented PE (MDO-PE) and Biaxially Oriented PE (BOPE) which are gaining traction in consumer packaging applications. While orientation technologies have long been established, they have only recently come to the fore in consumer packaging applications with blown MDO-PE, BOPE and newly, cast MDO-PE films available on the market. This has been enabled by collaborative efforts across the supply chain to help deliver fully recyclable, all-PE film structures.

With PE films representing the largest segment of the flexible packaging market, the recycling infrastructure is most advanced for this material. Oriented PE films are increasingly viewed as a sustainable solution, offering strong mechanical recyclability a feature further supported by growing global investment in PE recycling capabilities.

Several leading film extruders and converters are actively championing these technologies, recognising their potential to reshape the packaging landscape. However, the path to commercialisation is capital-intensive and time-consuming. Following a wave of post-COVID investment in blown MDO-PE and BOPE capacity, the pace of expansion has moderated. Market adoption has not accelerated as rapidly as anticipated, largely due to the steep learning curve associated with new material development and the complex, multi-stakeholder nature of R&D efforts.

Demand to Accelerate with Legislation

Despite growing interest, the widespread adoption of oriented PE films continues to face several headwinds. Higher production costs compared to conventional films, significant capital investment requirements, and ongoing technical and performance challenges have slowed market uptake.

Initial optimism has been tempered by a disconnect between brand owners’ sustainability commitments and their actual purchasing decisions, which often continue to prioritise cost over environmental benefits. Many global brands, once quick to announce ambitious sustainability targets, have since revised their goals acknowledging that early timelines and material specifications were overly optimistic. As a result, the transition to oriented PE films is progressing more gradually, with revised targets and more flexible parameters now guiding adoption.

Looking ahead, legislative pressure is emerging as the most decisive factor driving change. Regulatory clarity is helping companies navigate the complex landscape of sustainable packaging, prompting more confident and strategic investment in recyclable film solutions. As legislation continues to evolve, it is expected to accelerate the shift toward recyclable packaging formats, including oriented PE films, and bring about more decisive industry action.

In the latest market report from AMI, titled “PE Consumer Packaging Films – The Global Market 2025”, our expert consultants have combined first-hand industry insight across all PE film technologies with data analysis to give a comprehensive picture of this increasingly important sector. The research, which was released in June 2025, gives investors and industry participants a thorough grasp of the competitive challenges, market dynamics, and industry development.